This is news regarding price reductions across Hyundai passenger vehicle portfolio, effective September 22, 2025. This is a direct result of the recently revised GST rates on automobiles, and Hyundai Motor India Limited (HMIL) is fully passing on the benefit of this tax reduction to valued customers.

This significant move by the Government of India to reduce GST rates, bringing small cars to 18% and simplifying the overall structure, is a welcome relief for both buyers and the automotive industry. Larger vehicles will now be taxed at a flat 40%. We are proud to be among the first automakers to extend the complete GST benefit to our customers, making personal mobility more affordable and accessible, especially ahead of the festive season.

The extent of these price cuts varies by model and segment. Premium Hyundai Tucson will see the biggest benefit, with a reduction of up to Rs 2.40 lakh. Popular mass-market models such as the Venue, i20, Exter, Aura, and Nios will also become significantly more affordable, with price cuts ranging between Rs 73,000 and Rs 1.23 lakh.

As Mr. Unsoo Kim, Managing Director, Hyundai Motor India Limited, stated, “We sincerely appreciate the progressive and far-sighted move by the Government of India to reduce GST on passenger vehicles. This reform is not only a boost to the automotive industry but also a strong step towards empowering millions of customers by making personal mobility more affordable and accessible.

As India moves forward on the path of Viksit Bharat, Hyundai remains committed to aligning with the nation’s growth ambitions by ensuring our cars and SUVs continue to deliver value, innovation and joy of driving.”

In addition to Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Toyota Kirloskar Motor, Renault India, and Skoda Auto India, several other manufacturers have also passed on the GST benefit to customers through price reductions.

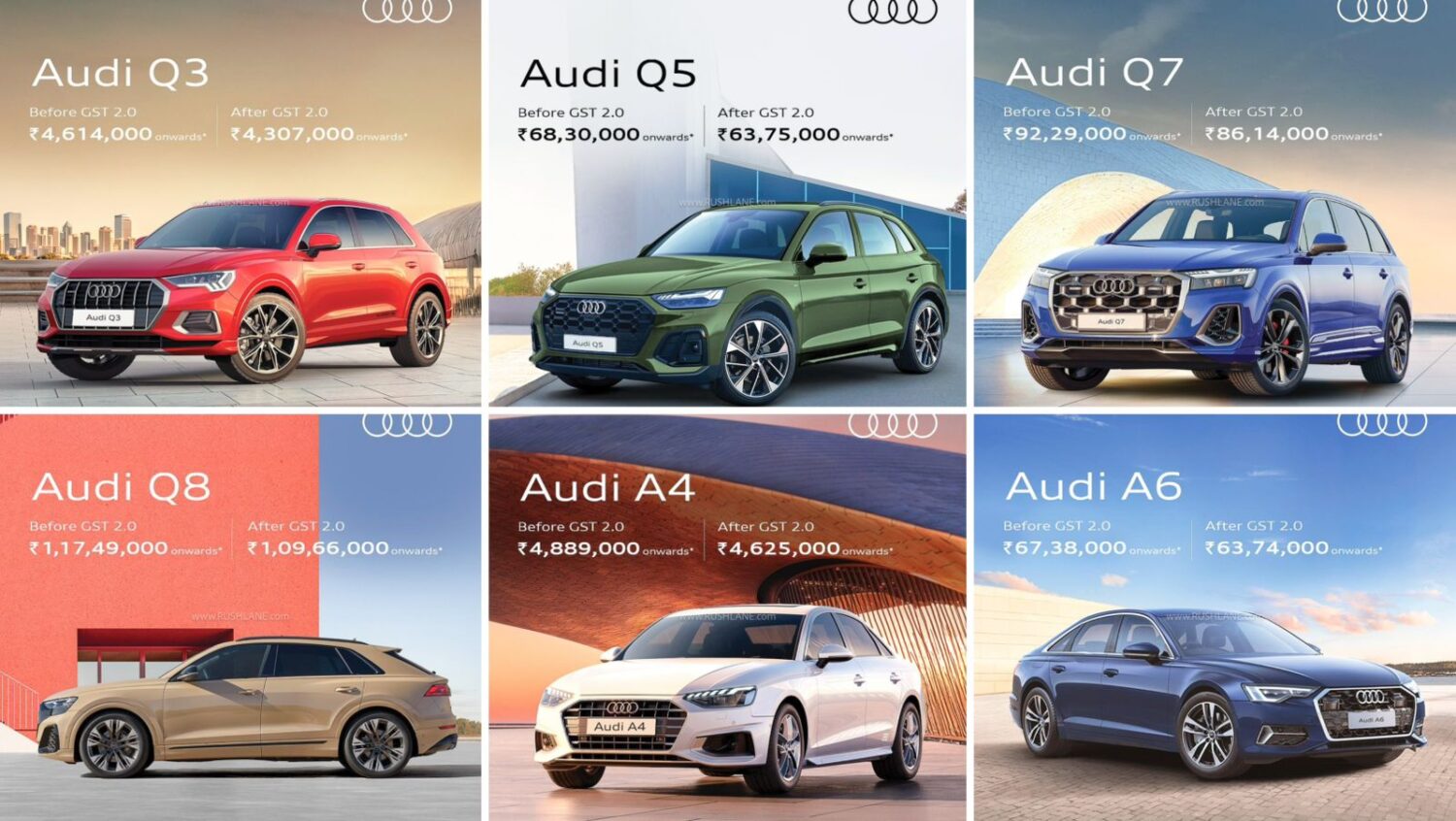

Among the luxury car manufacturers, Mercedes-Benz India and BMW Group India have similarly followed suit by adjusting their prices to reflect the GST benefits.

Leave a Reply